For years, the real estate industry has sought a modern closing experience that is fast, transparent, and secure. However, achieving this vision has been challenging since each closing party often operates within their own siloed software system that doesn’t easily communicate with other systems. Many title agencies are lured into believing that the only way to support transaction complexity is by building hundreds of workflows and then investing in custom integrations. Unfortunately, this level of customization often magnifies the problem by creating additional complexity and inefficiencies—especially between different systems. It doesn’t need to be that way.

Closings can only move as efficiently as information is able to be exchanged and acted upon by each party in the transaction. In order to realize an optimal transaction experience for everyone involved, the real estate and mortgage industry needs to rethink the processes and systems that everyone uses to connect.

Three must-haves for enabling a Connected Transaction

There are three must-haves for enabling a Connected Transaction to occur at scale. These components must coexist in order for title agencies to provide a modern experience for clients and consumers.

1. Execute a strategy that takes all stakeholders into consideration

In its current state, the real estate ecosystem is very fragmented. Although the industry is making progress toward a more modern transaction process, many businesses are investing in more and more isolated point solutions over time, and in doing so, are creating a fragile ecosystem with significant maintenance costs.

There are so many stakeholders who need to collaborate for a transaction to be successful. Unfortunately, if there’s a high level of isolated complexity across the industry, collaboration among parties breaks down.

Today’s status quo involves very complex title production software and very complex loan origination software that are connected through middleware or cumbersome integrations with restricted collaboration functionality. This technology infrastructure means that each party has its own processes, objectives, and isolated solutions. Technology with these operational siloes is error-prone, expensive to maintain, and limits the ability to continuously innovate given the interdependencies of each solution. As a result, transaction parties often find it difficult to drive efficiency across the transaction.

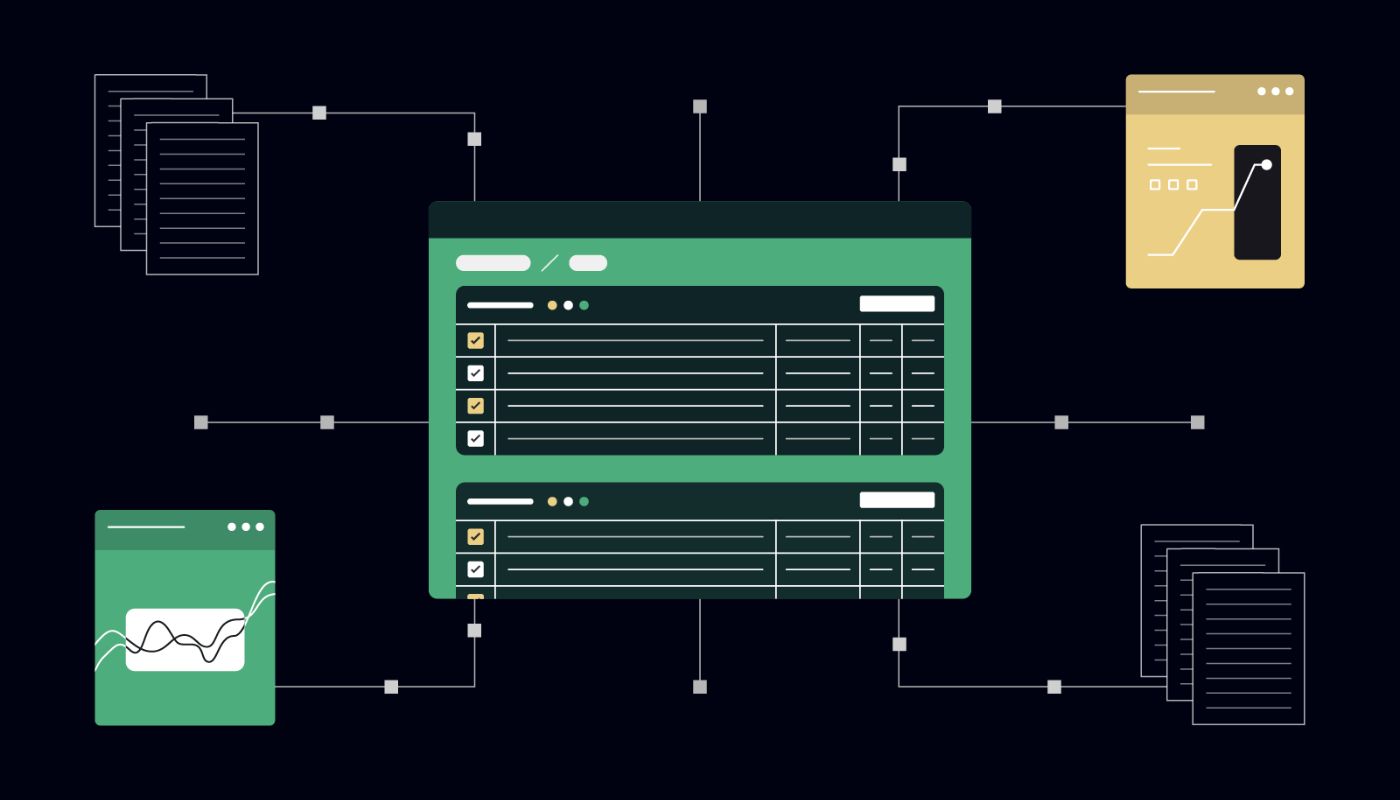

Removing complexity across the industry and driving consistency where possible will improve collaboration and communication among all parties. This state could be accomplished if the industry was to operate through a cloud-based single platform to accomplish all aspects of the transaction. This more connected ecosystem would facilitate collaboration across all closing entities. Instead of connectivity being an afterthought, this system would be built with connectivity and cross-functional collaboration at the forefront. This system would remove some of the common obstacles preventing businesses from delivering a seamless transaction experience, such as disjointed systems and lack of transparency during transactions.

2. Do not be a victim of ‘complexity takeover’

With the proliferation of technology tools available to real estate professionals in recent years, many title agencies have adopted multiple tools to tailor the closing experience to fit the unique needs of their clients. Unfortunately, having an excess of technology tools often overcomplicates the closing process. In this scenario, employees have to navigate multiple systems to accomplish tasks and keep track of information. Additionally, these various tools often lack the ability to integrate with each other, requiring employees to rekey data and switch between systems during transactions. This unnecessary complexity can slow processes down and reduce consistency since data is stored across multiple tools. In the long run, these obstacles lead to slower closing times and increased human error as employees manually accomplish tasks.

Well-designed workflows help title agencies drive efficiency and cross-functional collaboration. At Qualia, we have developed a Workflow Framework to help title agencies manage the complexity of a real estate transaction without sacrificing the usability and scalability of their solution, or constraining their ability to collaborate effectively with their stakeholders. With this framework, title agencies can limit their number of workflows to maximize efficiency, improve process implementation, and adapt to meet changing demands—all while supporting geographic and transaction-based nuances. Overall, a focus on simplicity can help title companies optimize their workflow design to improve operational efficiency.

3. Partner for ongoing innovation and growth

Software providers themselves must also work to prevent unnecessary complexity in their software. Software that enables too much customization can be confusing and overwhelming for users and ultimately lead to overcomplicated processes. Too much complexity also causes the software to eventually hit a saturation point. When this happens, it hurts the provider’s ability to maintain the software and fix bugs in the system (because there will be too many). These challenges make it difficult to build resilient software that empowers its users to deliver modern transactions.

Instead, software that is designed to simplify complex workflows will better manage the complex nature of real estate transactions. Standardizing how people communicate and share information provides a single solution for data synthesis, which facilitates better reporting and provides valuable business insights for planning and forecasting. From a cost perspective, it also eliminates the ongoing fee of maintaining expensive integrations and point systems. With a Connected Transaction built on standardization, collaborative experiences are incorporated into the software to give users the ability to connect with other systems (such as that of their lenders or real estate agents) with ease. By investing in modern software, title agencies are able to save time, remove unnecessary complexity, and connect more seamlessly with other closing parties.

Moving towards a more connected ecosystem

While there are nearly infinite variations of tasks required to close a transaction, the core concepts remain constant. Moving away from complex and unmanageable workflows can empower the entire real estate ecosystem. It can also create a single source of truth for all information pertaining to a transaction—paving the way for homebuying to finally be a simple, secure, and enjoyable experience. At Qualia, we feel strongly that creating simple workflows that support the majority of transactions (while providing the flexibility to support unique transactions by adding task groups based on new information) will save title agencies time in the long run. It will also lead to more manageable workflows that enable teams to find new, innovative ways of completing their work.